Home / News and Updates

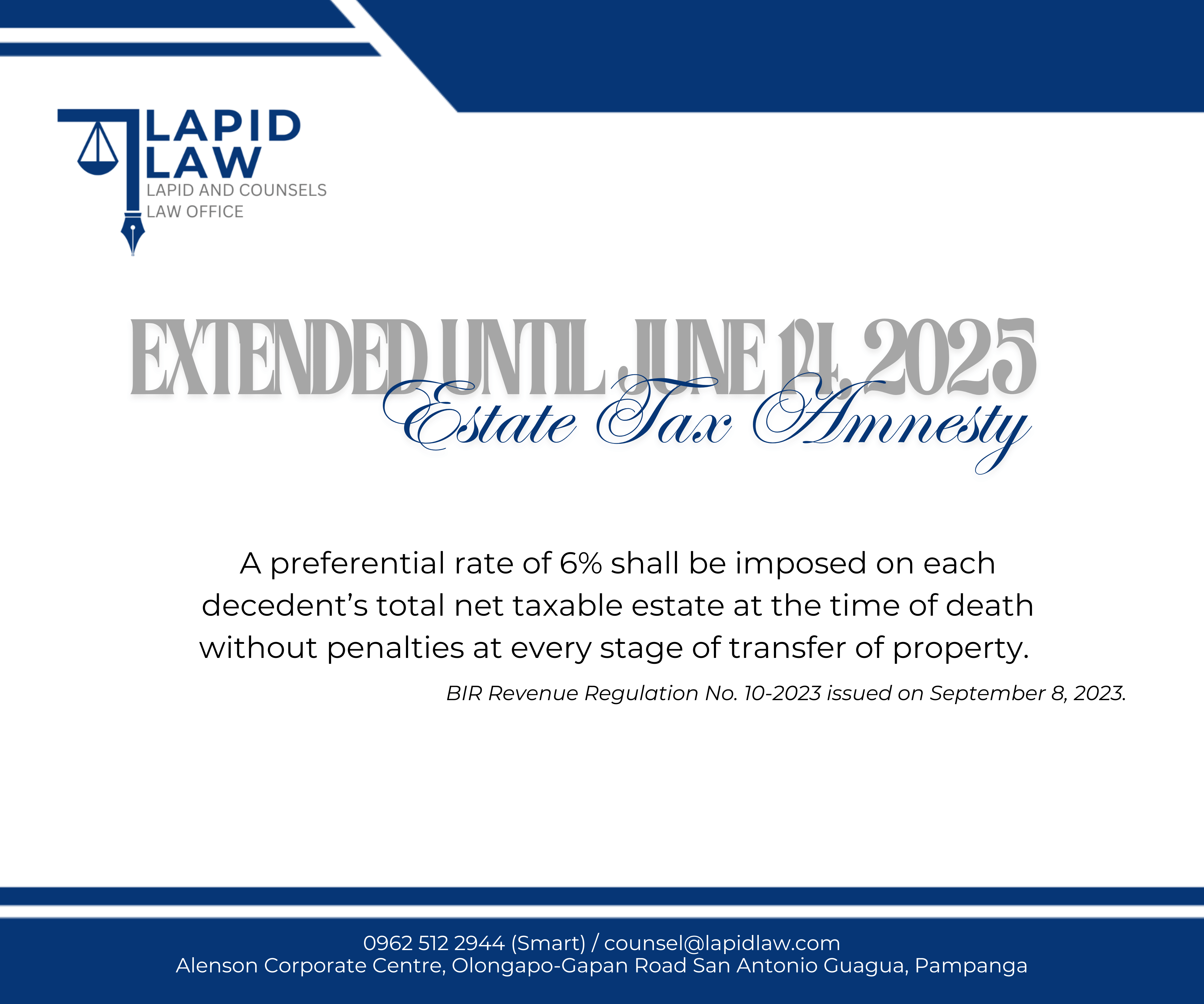

Under Revenue Regulation No. 10-2023, issued by the Bureau of Internal Revenue on September 8, 2023, qualified estates may avail themselves of the Estate Tax Amnesty at a preferential rate of six percent (6%) on the total net taxable estate of each decedent at the time of death, without incurring penalties at any stage of the property transfer. This amnesty is available to the estates of decedents who died on or before May 31, 2022, whether or not assessments have been issued, and whose Estate Taxes remain unpaid or have accrued as of that date.

The deadline for availing of the said tax amnesty has been extended to June 14, 2025.

Legal Disclaimer:

The content on this website is for general informational purposes only and does not constitute legal advice. Lapid and Counsels Law Office (Lapid Law) makes no representations or warranties regarding the accuracy or completeness of the information provided. Accessing this site does not create an attorney-client relationship. For legal advice specific to your situation, please contact a qualified attorney directly. Do not send confidential information via email or this website until a formal attorney-client relationship has been established.

© Copyright. Lapid and Counsels Law Office 2025. All Rights Reserved.